Employers are constantly battling the burden of ever-increasing, employee health care expenses. The Health Matching Reimbursement Account (HMRA®) program represents the missing piece in group plan design for employers to not only contain their health care cost increases but to actually experience dramatic savings over time. The HMRA® is “The Employer’s HRA” because it is a medical reimbursement program owned by the employer. The HMRA® program design offers employers numerous incentives to secure and maximize additional health care savings for their organization over time that would not have been possible before.

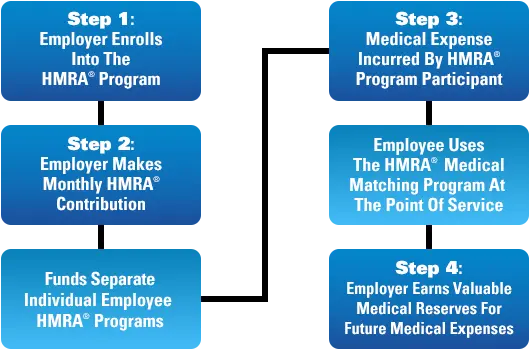

How The HMRA® Program Works In Four Easy Steps

Step 1: Employer Enrolls Into The HMRA® Program:

The HMRA® program takes any Health Reimbursement Arrangement (HRA) plan design to the next level. The HMRA® is also the ideal complement to any employer’s HRA program because the HMRA® Program and its powerful monthly medical match on the employer’s contribution can be used as a funding vehicle for the employer’s HRA program itself. The HMRA® matching can be implemented by employers through a separate plan document to fund a Section 105 HRA plan design for all of their participating employees that they can use to pay for eligible medical expenses up to the group member’s current HMRA® medical matching amount at the time of each claim.

Step 2: Employer Makes Monthly HMRA® Contribution:

The employer is the owner of the HMRA® program and makes a defined, monthly contribution on behalf of all of their participating employees. This contribution is allocated to build individual, HRA medical matching amounts available for each participating employee that can be used to pay for eligible medical expenses. The HMRA® pre-funds employee claims ahead of time into HRA accounts that earn a medical match to be used by each employee that grows following each monthly employer contribution. The medical reserves that are allocated each month into the group members’ separate HMRA® medical balances that are not filing medical claims will serve to help reduce an employer’s future, employee medical costs through the powerful HMRA® monthly, medical match that the employer’s HRA program is receiving each month for their employees. This medical match for the employer awards them up to $2 or more in medical matching for every $1 above and beyond what they contribute towards each employee’s individual plan each month as the program progresses.

Step 3: Medical Expense Incurred By HMRA® Program Participant:

Employees can use their HMRA® medical balance to pay for eligible medical expenses up to their current available HMRA® medical balance at the time of their medical claim.If, for example, an employee had a $500 HMRA® 5000 cumulative medical matching and incurred a $1,000 qualifying medical expense, the HMRA® would pay for the first $416 of that claim. Each individual employee program must maintain a minimum of one month’s contribution (in this case $84) in their program at all times. Employees will be able to view their updated amount of HMRA® medical balance anytime either on their HMA® member portal or mobile app.

Step 4: Employer Earns Valuable Medical Reserves For Future Employee Medical Expenses:

Employers can now provide their group members with enhanced matching through the HMRA® Program and also create opportunities for richer, employee health plans while reducing cost-sharing obligations with their employees over time. This is because the rapid growth of their employee HMRA® medical matching will serve as vital medical reserves for the future to save the employer significantly on employee health care expenses over time and help them to be able to cover more and more of the most common and expensive part of their exposure to their employees, which is their first-dollar employee medical needs.

The Health Matching Account Services HMRA® Program is not health insurance.

Health Matching Reimbursement Accounts are a patent-protected product.

Claim cost and frequency may vary by group. Charges and fees may vary by group. This is not an illustration or a formal quote. Ask your broker for a formal quote.